Are you wasting time processing expenses?

Expense claims are an administrative burden for all businesses. From taxis, flights, meals, supplies, and everything in between – there are countless expenses that need to be reimbursed to the people who work at the company. But it’s amazing how the simple task of reimbursing employees turns into a paper-filled back-office nightmare.

With many apps now available, the task of tracking and recording expenses is becoming easier and more efficient, saving business owners and their accounting team hours in administrative time.

We love Xero and their new Expenses function where employees can capture receipts and submit claims for their work expenses with their mobile device. Let’s have a look at how it works and how it can save you hours in dealing with paperwork.

Xero Expenses:

Xero Expenses works seamlessly with Xero accounting package, and has all the tools and insights small businesses need to efficiently track and manage expense claims. You can now Capture expenses on the go and keep everyone up to date with push notifications.

A better way to manage expense claims in Xero

The Xero Expenses offers small businesses a more efficient way to manage expense claims with:

- Faster expense captureto reduce data entry through automatic scanning of receipts and eliminating the need to store paper versions.

- iOS and Android appspush notifications to let businesses, employees and advisors capture, submit and keep up to date on the status of expense claims from anywhere.

- More flexible user permissionsto give complete control of whocan view, submit, and approve or pay an expense claim for or on behalf of someone else.

- Simple and intuitive workflowsto make it easy to see where an expense is at, review and approve all unpaid expenses, and create batch payments to get employees paid promptly.

- Greater insights and powerful analyticsto empower businesses and their advisors with a detailed and real-time understanding of spending habits and patterns.

- And with multi-currency, relevant notificationsand seamless Xero accounting integration, the new Xero Expenses is smarter, easy to use, and designed to benefit both the small business and their employees.

—

Advantages

- Easily capture and submit expenses

You’ll find automatic receipt processing in the Xero Expenses. Small business owners can easily capture and submit expense claims through their mobile device on both iOS and Android. Simply take a quick picture of the receipt and let Xero submit the expense claim. The design and workflow improvements make it easy to capture and submit an expense claim without the paper chase or endless follow up.

- Eliminate Hidden costs

With reduced data entry and by streamlining everything from submitting expenses through to reconciling transactions, you can eliminate the hidden costs.

- Better visibility

You can see all the most important information at a glance, so you always know where your expenses and cash flow stand.

- Enables Growth

Access valuable real-time reporting and powerful analytics to monitor patterns, plan ahead and make fast, informed decisions.

- Flexible controls and permissions

The user permissions model gives more flexibility and control to the right people at the right time during the expense claims process. This significantly simplifies the workflow and boosts efficiency. That’s because only appropriate people in the business can view, submit, approve or decline, and pay an expense claim.

You can also find a highly-requested feature – the ability for a user (typically an accountant or owner) to submit an expense claim on behalf of other people in the organization. The relevant people will receive real-time push notifications on their mobile phones, which makes it easy for accountants, business owners and employees to keep each other up to date.

- Easy review and payment

Xero expenses provide you list views and expense drill-down views, which can save you time and let you enjoy better functionality:

- The expense claim list immediately gives you a high-level view of your own or your employees’ expense claims in easy-to-consume groupings, such as by status or by employee. The most important information required for review, approval and payment are available at a quick glance. These include status, amount, expense account, description, vendor and date. From the list, just one click will let you drill down into the details of the expense – and provide a view of the receipt, tax details, tracking categories and associated label.

- You can view approved expenses claims that are awaiting payment within bills. Xero provide links to and from bills, so you can conveniently view bills associated to expense claim reimbursement side by side with vendor and supplier bills. This allows you to more easily make a decision around who and what gets paid in one simple view.

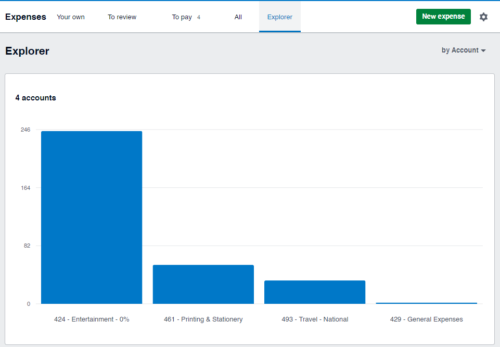

- Expense analytics

Quite simply you have to know how your staff spends money and if they follow established rules and policies. An exciting new feature gives small businesses and their accounting partners deeper insights into spending and expense claims that will provide actionable findings. Accountants and business owners have access to a real-time and accurate view of their expenses.

With Xero Expenses function, expense claims are no more a burden. It makes create, review, approve and paying an expense claim not only easy but also quick. It saves a lot of time and provides you the opportunity to enjoy better functionality. If you need any help exploring Xero Expenses or any other Xero features, talk to one of our trained bookkeepers and we will be happy to assist you.