6 Reasons your bookkeeper is harming your business

Whether your bookkeeper is someone you have employed years ago, maybe it’s the admin assistant, or even your wife or mother in law, you need to be confident that they are doing a good job and looking after your business’ bottom line. A competent bookkeeper could be the difference between helping your business grow or letting it spiral out of control with mounting costs and decreasing margins.

As a busy business owner, you have plenty of other responsibilities that come with running your business and you might not know if your bookkeeper is taking you to the cleaners. The stories we year about bookkeepers defrauding hundreds of thousands of pounds from the businesses they work for and spend it on nice cars, expensive holiday and designer clothes. And these are the ones that got caught and were sent to prison!

How do you know what good bookkeeping actually looks like, let alone spot the warning signs that your bookkeeper is bad at their job and hurting your business?

To help, we’ve put together this list of tell-tale signs to help you determine if you’ve hired a bad bookkeeper who is harming your business or one worth keeping.

- They’re not qualified and not backed by professional body

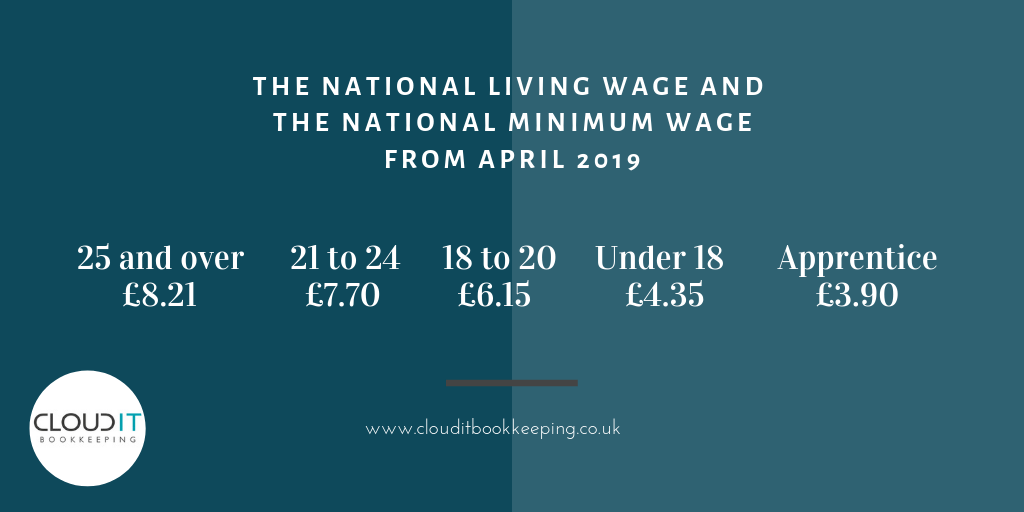

Anyone can say that they are a bookkeeper just because they can enter invoices into your accounting system. However, bookkeeping is much more than just data entry. Someone without formal training can create chaos and confusion with the figures in your accounts, make VAT or PAYE errors and give you wrong information which you then use to make business decisions. To avoid hiring a bookkeeper that can’t do the job and do it well always check whether they have bookkeeping qualifications such as The Institute of Certified Bookkeepers (ICB) or Association of Accounting Technicians (AAT). A qualified bookkeeper would have certification and backing of their professional body and would have to adhere to professional standards set by them too.

What you can do: Before hiring the bookkeeper ask to see their training certificates or practice licence. If they do not have formal qualifications, you would have to assess if their experience is extensive enough to support your business appropriately.

- They don’t understand basic bookkeeping terminology

Your bookkeeper should know standard bookkeeping terms, including double-entry bookkeeping, cash and accrual basis, aged debtors/creditors, assets, liabilities, journals and so on. This relates to point 1 above too. Worryingly, we have spoken to other ‘bookkeepers’ who didn’t know what ‘reconciliation’ meant and also some have never seen or entered a journal. Lack of understanding of these terms will reflect in the basic bookkeeping entries and in turn the overall picture of the business’ financial position. One of the major jobs we do when taking over clients books from other bookkeepers is untangling their accounts by correcting wrong postings of payroll costs, VAT and PAYE liabilities, fixed assets and simple duplication of costs.

What you can do: Speak to your bookkeeper using the terms you want them to use. If they don’t use the correct terminology and it remains an issue, consider replacing them. A competent bookkeeper must be able to talk the talk.

- They are always behind on the books

Your business can’t grow if your books are always behind and you are forever catching up. You need to have correct and up-to-date information when you are making business decisions, such as how much can you spend on marketing, can you hire another person, can you find savings if you moved office – to name a few. Things can come up to cause delays, just as they do with any job, but a good bookkeeper looks for opportunities to get caught up and maintaining deadlines.

What you can do: Set clear deadlines at the outset of your relationship with the bookkeeper and hold them to these. Check in regularly to make sure they are on track and have everything they need to complete their tasks.

- They don’t let you see the books

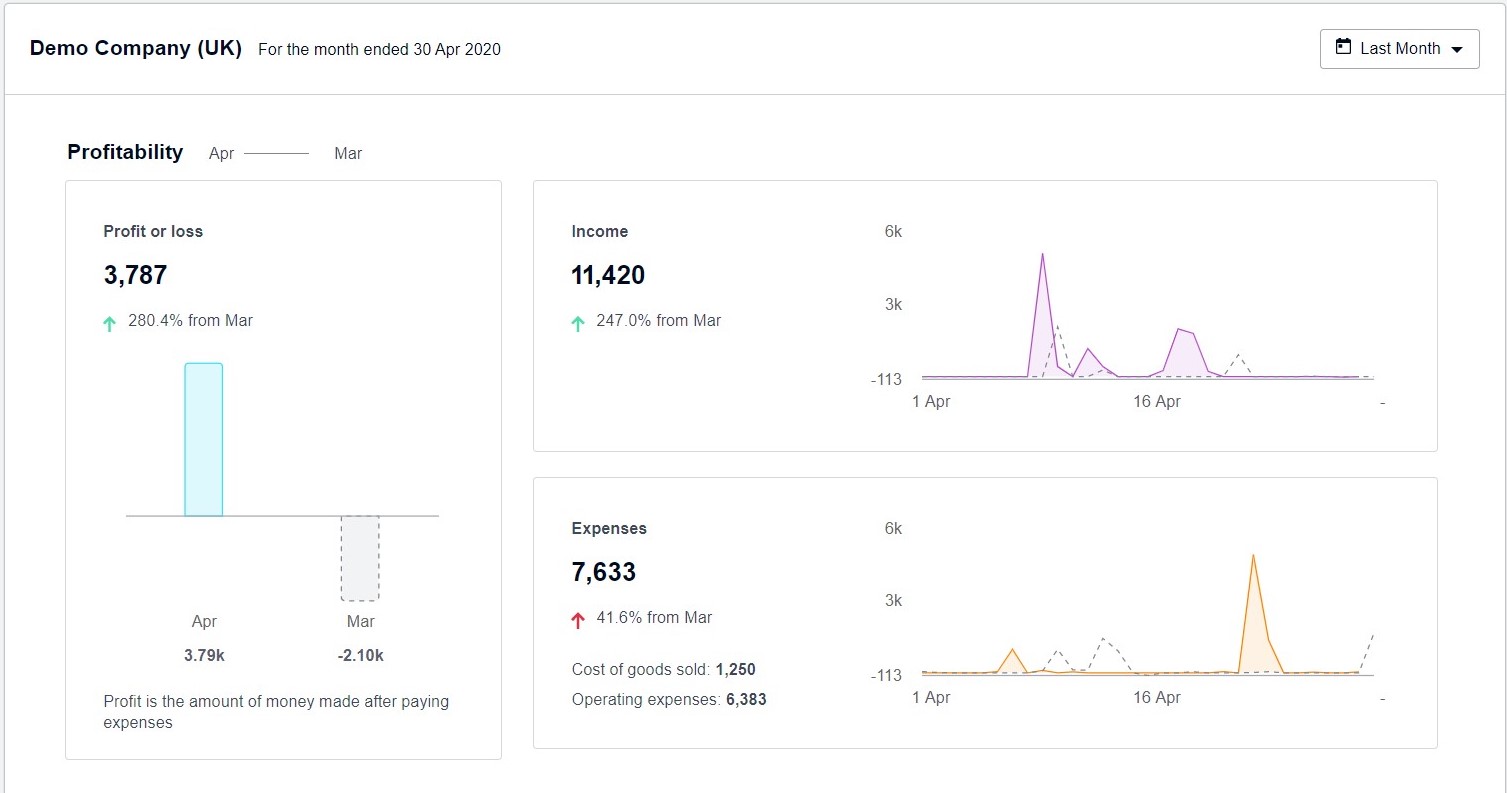

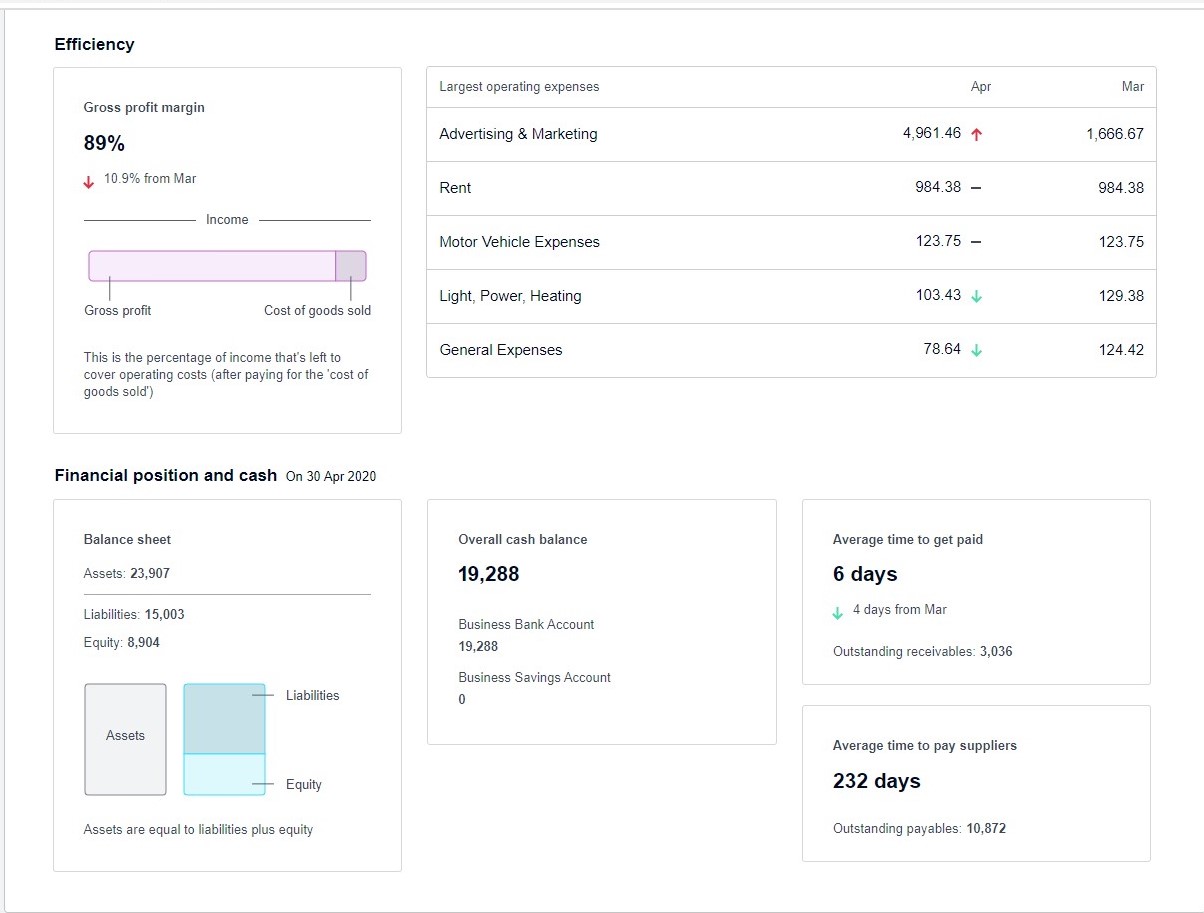

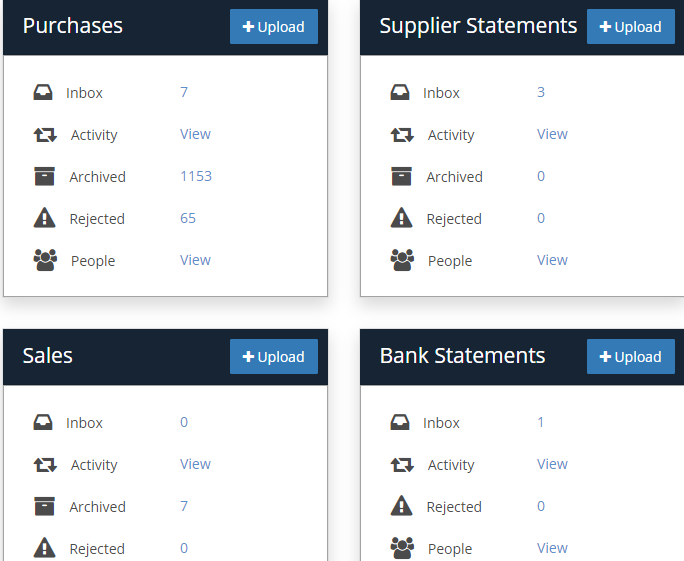

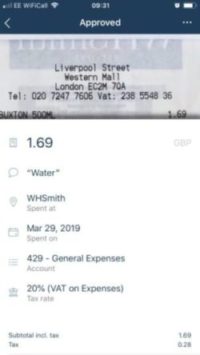

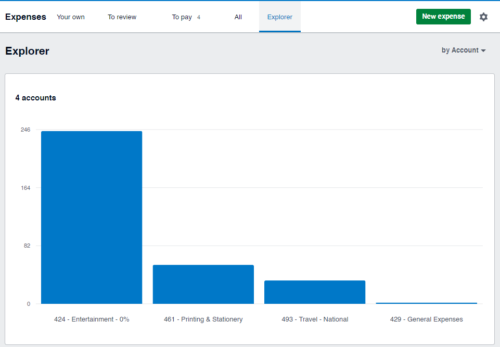

A bad bookkeeper will want to keep you out of the know and will be unwilling to let you see the books. This is a major sign that they are hiding something, like mismanagement of your books, or worse – they could be stealing from you. If they become defensive or overly protective when you ask to see the books that is the time you must step in and seek transparency. Remember, with cloud accounting software like Xero transparency is always there and all parties can see the same live date using their own access. It becomes more difficult to hide bad work or blame someone else.

What you can do: Demand control of the books and take ownership of account login. If your bookkeeper puts up a fight or denies you access, seek an alternative bookkeeping solution. Such behaviour is not part of professional conduct of a certified bookkeeper.

- They don’t ask questions

You might think that bookkeeping is a repetitive, mundane chore that doesn’t require any sort of inquisitive thinking. But that’s wrong. A good bookkeeper is not afraid to ask questions and dig deep to find answers. This helps them identify problems and suggest costs cutting opportunities, find areas to improve on, which helps drive your overall goals of growing your business. If your bookkeeper never asks questions, do they care about your books or your business? Indifference will lead to missed opportunities to help your business.

What you can do: Ask your bookkeeper questions, challenge them, and request suggestions on how to cut costs.

- You question their work

Trust your gut – deep down you know when things are not right. If you don’t know what your bookkeeper is up to because you only hear from them after you’ve chased and chased again and you have no idea where your business is financially, then it’s time to take action right away. Similarly, you have that feeling that your bookkeeper is doing it wrong, or you’ve seen the same mistakes over and over again, then it’s time to find a new solution.

What you can do: Trust is important when working with your bookkeeper! After all you are sharing your business’ (and personal) most sensitive information with them. If you can’t trust them, you need to find someone you do.

In the end it all comes down to your bottom line. Are you happy with your current bookkeeping solution? Or do you need to review your approach and find a better solution?

Talk to our experienced team to find a trusted bookkeeper for your business, have less stress and gain clarity for yourself and your business.