3 Lessons Digital Agency Owners Can Learn from Nick Suckley?

The book “Start. Scale. Sell. 75 Lessons for Business Success” arrived on Friday morning and I have finished reading it by Sunday. The book just flows and is an easy read with concise lessons and examples. I believe any agency owner reading this would relate to most lessons Nick Suckley learned building and selling Media21 and Agenda21. I have picked out 3 that hit the cord the most with me being involved in helping digital agency owners manage and plan their financial side.

What can you, Digital Agency owner, learn from Nick Suckley’s experience?

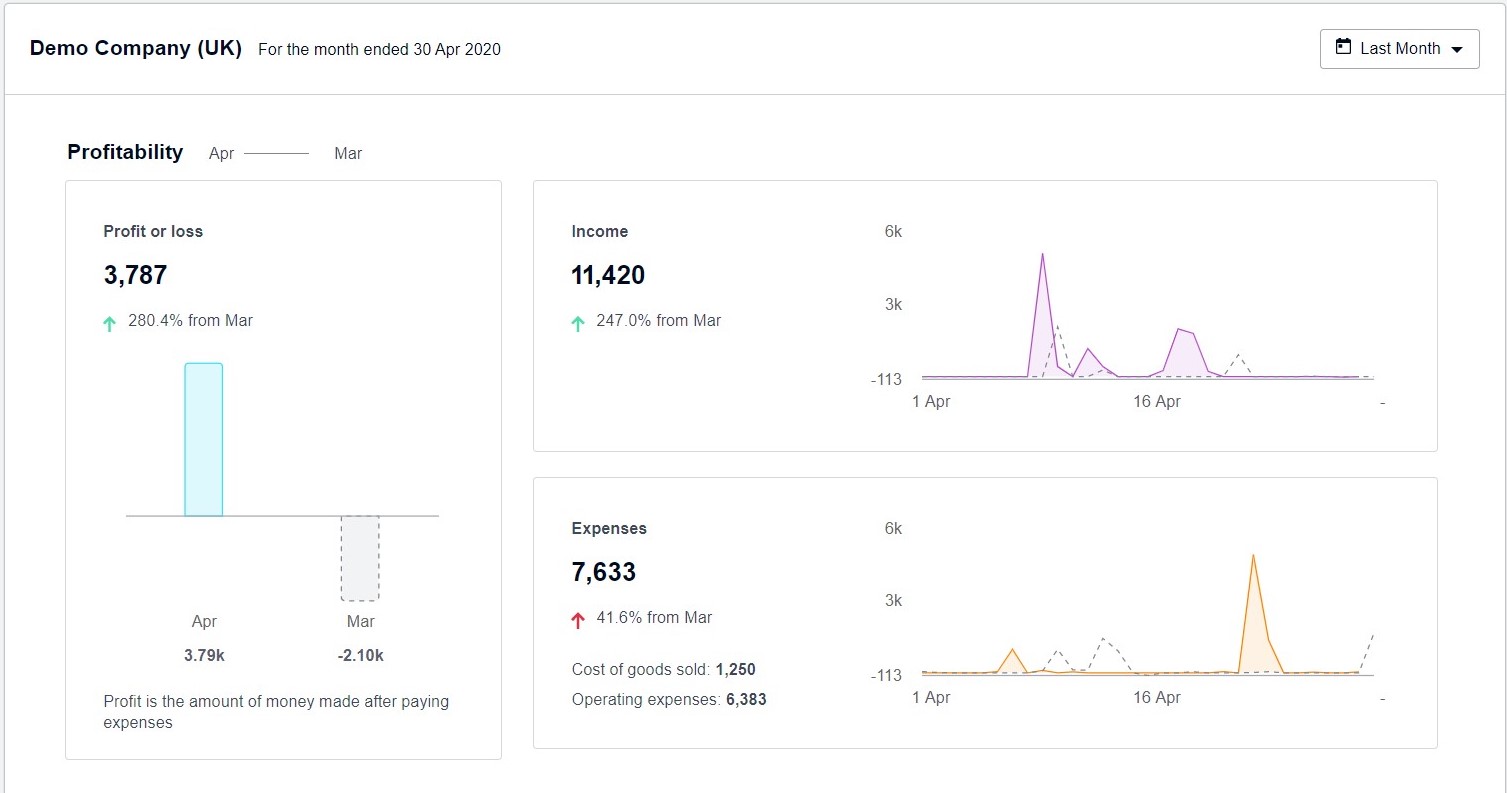

- Measure your KPIs but don’t overcomplicate. Simplicity is key if you want to understand and use your numbers. The list of key performance indicators Nick uses is:

- Pipeline – number and size of potential customers. If you do not have a sales strategy or there is no real sales pipeline, this will hurt the business most in the long run. You cannot leave new business to luck or referrals. This is unsustainable if you wish to grow. Imagine your best earning client decided to bring it all in-house or move the service you provide to another agency which usual mean you receive an email saying “we are bringing all our digital marketing under one roof and agency XYZ can do it all”. New business is the top 1 reason agency owners are stressed and anxious. Having data on sales pipeline will give you clarity and focus.

- Pitch-to-win ratio – how many potential clients you converted via pitch or proposal. This is important as it will give you an understanding if your pitch material works and where you need to make changes. Correct positioning can help here too.

- Billings per head – measure how productive your team is and if you are over or under servicing clients. The more efficient your team can be the more billings per head you can have.

- Income-to-salary ratio – measure how profitable and productive the company is. If this ratio is too high you need to cut salary costs or increase your billings.

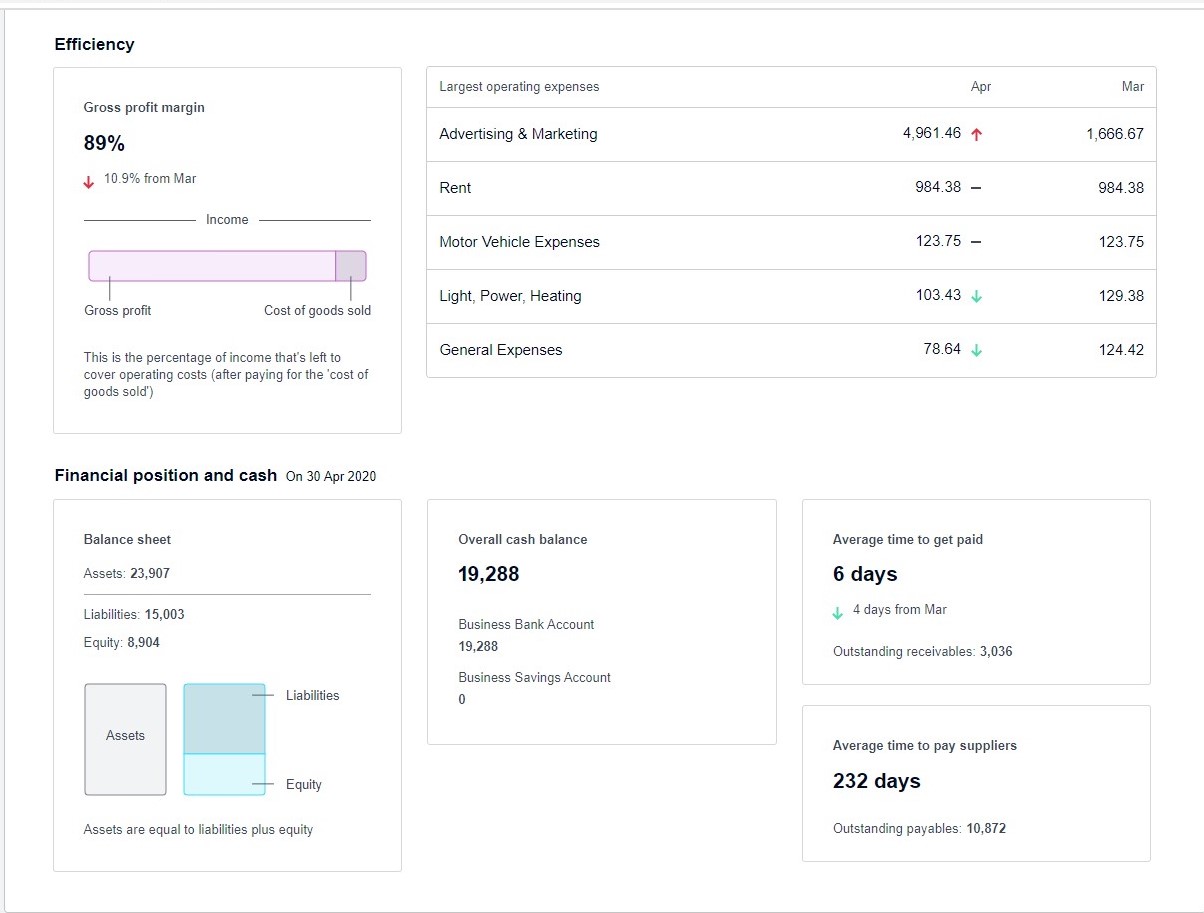

- Gross profit margin – how good you are at charging clients.

- Net profit margin – how profitable you are.

- Boost profitability – use the right tools. Nick calls this Profit Improvement Programme (PIP). You need to understand how each area of your business is generating income and what are the costs associated with it. Track each service you offer and associated team’s Profit and Loss (P&L). You might have media, paid search, SEO, social, affiliates and analytics services. You would match income with team costs for that service and any other associated expenditure. This will give you the profitability for each service area you provide. Nick has the Golden Rule which each team leader has to follow. This is – staff cost cannot be more than 50% of the income generated. If you follow this rule, you will have enough left for the general overheads and your own pay. Get this right and you will see great improvement in your net profit margin.

- Never make a loss. This is a tough but most important rule in my view. Nick Suckley argues that by not making a loss you do not lose control. Making decisions quickly when times are tough, cutting costs and staff will save your business. These are the toughest decisions for any owner but can mean survival or going under. That’s why having up-to-date and accurate financial information will make a difference and provide the data you need to make those vital decisions. You will have the gut feeling that things need to change, or things are not going quite right. Having your financial reports in good shape will help you understand the situation better.

What can you do right now to make a difference to your business?

Take these 3 steps today and you will be on the path to success:

- Measure, measure, measure. Decide on your KPIs, measure and report on them at least monthly. You will need to track staff hours spent on client work, service team P&L, sales pipeline and anything else you decide is vital in making business decisions. Start with simple Excel spreadsheet and build from there. You don’t need to overcomplicate it.

- Analyse your management reports monthly. Review your accounting function and make sure you have accurate data at least monthly. If you do not have management reports, then look at your P&L and Balance Sheet as a minimum.

- Set net profit percentage you want to achieve and maintain. Do everything you can to keep it above this level. Paying yourself is the number one priority.

If you are not sure where to start, we can help you get started and support your agency with providing accurate and up-to-date accounts information, reports and tracking. Get in touch with us today.