Fuelling Your Financial Race: Boosting Creative Agency Profits with Lessons from the F1 Track

Running a creative agency can feel like hurtling down the Monaco Circuit at 200 mph. You’re juggling creativity, client demands, and your triple-shot latte when—boom—you remember those pesky financials. But fear not! Just as Formula 1 success isn’t solely about the flashiest car, your agency’s triumph isn’t just about stunning designs—it’s about making your bookkeeping and accounting work for you. Buckle up and let’s ride into this analogy!

The Nuts & Bolts of Creative Agencies

Behind every mind-blowing design, there’s a less glamorous but essential bit—financial management. Just as a Formula 1 car isn’t going anywhere without a well-tuned engine, your creative agency can’t thrive without keeping the books in check. It’s about as exciting as watching paint dry, but it’s the bread and butter that helps your agency keep the lights on and the coffee brewing. Neglecting the bookkeeping and accounting functions can lead to missed opportunities, non-compliance, and financial discrepancies, jeopardising your business’s success.

F1 and Bookkeeping: More Similar Than You’d Think!

Formula 1 is a symphony of precision, efficiency, and those incredibly fast pit stops (I mean, how do they change tires so quickly?). Similarly, in your creative agency, disregarding the nitty-gritty of accounting can cause more pile-ups than a wet race at Spa-Francorchamps.

Efficient bookkeeping and accounting in your creative agency can yield substantial returns. Accurate, timely recording of transactions, quicker financial reports, and efficient payroll management are just a few aspects where efficiency can translate into significant time and cost savings. This newfound time can then be channelled into nurturing your agency’s creative soul.

The Pit Stop Magic: Efficiency in F1 and Accounting

In F1, the motto is: every microsecond counts. Whether it’s a slightly faster tyre change or more aerodynamic wing mirrors, everything adds up to that sweet taste of victory.

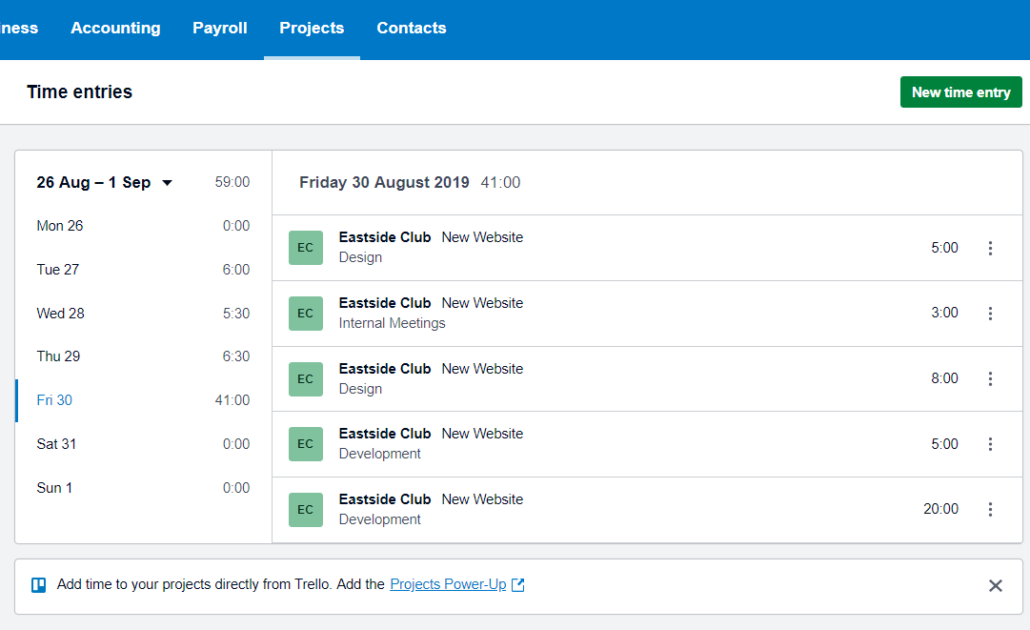

Your agency’s bookkeeping can follow the same principle. Shaving time off record-keeping, collecting payments, processing payroll like a pit stop, or getting financial reports quicker than an F1 car’s 0-60 – it all adds up, leaving you more time for your creativity thing.

The Power of Consistently Upgrading Your Gear

Data analysis is the secret sauce behind a winning Formula 1 team. Teams painstakingly analyse every race, every tyre change, and probably every lunch break to find improvements.

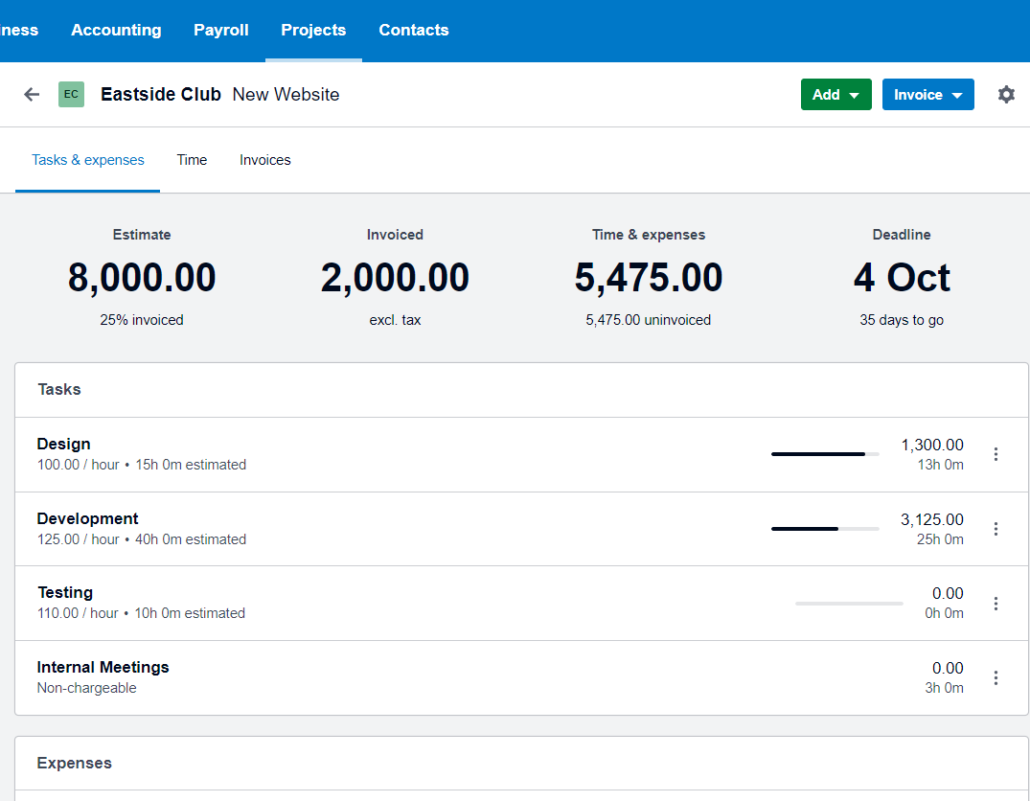

Now, imagine applying that same hunger for improvement to your financials. Consider the creative agency that increased profitability by optimising their invoicing process, thereby improving cash flow. Or the agency that outsourced their accounting to Cloudit Bookkeeping, freeing up valuable time to focus on their creative endeavours, leading to increased client satisfaction and subsequent profitability.

Victory Lap: The Payoff of Efficiency and Improvement

Formula 1 history is teeming with success stories where continuous improvement and efficiency led teams to glory. Take for example Mercedes AMG Petronas, their obsession with incremental improvements culminated in numerous championships.

In the business world, parallels are abundant. Consider the creative agency that increased profitability by optimising their invoicing process, thereby improving cash flow. Or the agency that outsourced their accounting to Cloudit Bookkeeping, freeing up valuable time to focus on their creative endeavours, leading to increased client satisfaction and subsequent profitability.

Just like a Formula 1 team can’t run on monster engines alone, your creative agency needs more than just killer designs—it needs a well-oiled financial machine. Handing over the financial keys to a specialist like Cloudit Bookkeeping might just be your ticket to the podium of success.

The race to success begins now! Embrace the power of efficient accounting, seek continuous improvements, and prepare to take your creative agency to the podium of success. Ready to accelerate your journey? Reach out to us and let’s drive your business forward, together. Because in the race of business, much like in Formula 1, every second counts.