5 Mistakes to Avoid When Reconciling Bank Transactions in Xero

Xero is cool and easy to use cloud-based accounting software designed for small and medium-sized businesses. However mistakes can occur and carelessness can result in many hours of wasted time trying to locate the error and rectifying it. Let’s look at some of the most common mistakes in bank reconciliation and how they can be avoided.

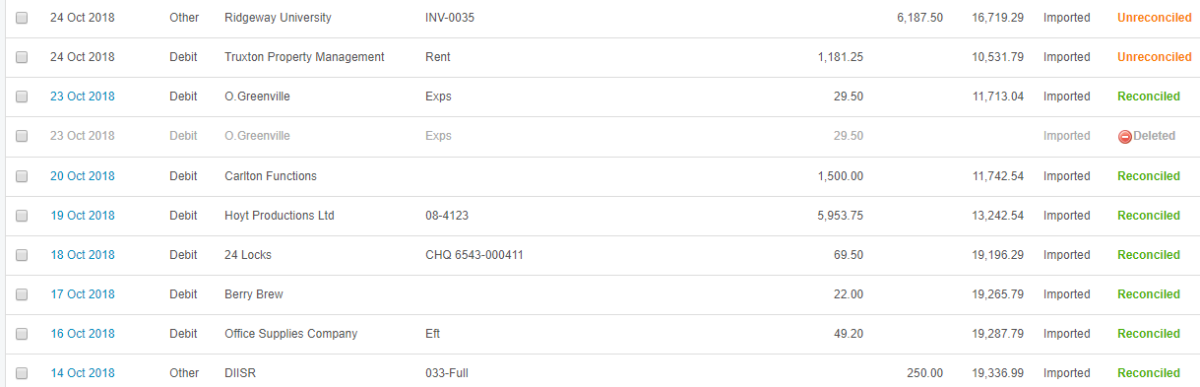

1. Trusting bank feed 100%

Direct bank feeds are amazing and most of the time we do not have any errors as they work perfectly. However, it can happen that there is a break in the feed and a day or more are missed, especially if you don’t reconnect the bank feed in good time. This will result in unrecorded expenses or customer payments unasigned to their invoice which you want to chase. Sometimes bank lines can be duplicated, for example on a credit card feed or bank feed where the transactions comes in on the day of the purchase and on the day it has cleared the account. If you reconcile all of these you will end up with double income and expenses in your accounts. To make sure everything is in order, regularly check your actual bank account balance with the running bank balance in Xero. If this does not match, you will need to compare your bank statements with Xero to find what is missing or imported twice.

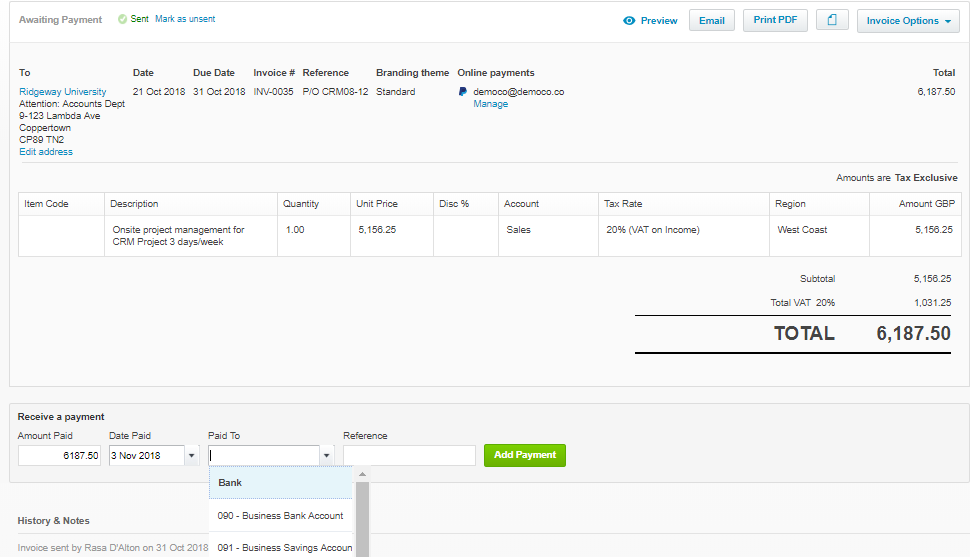

2. Paying invoices/bills

When marking sales invoices as paid in sales module or purchase invoices in purchases module, some users mistakenly record payment to/from the wrong bank account. This will cause reconciliation problems later on, as the invoice will not be available to assign bank payment against. To avoid this, always double check the selected bank account in the drop down menu when paying the invoice. Always run reconciliation report to check for anything out of place.

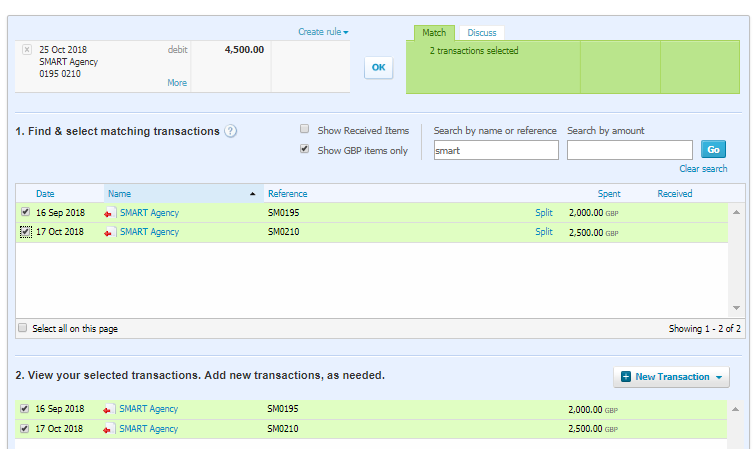

3. Bills to be paid vs reconciliations

When entering bills that need to be paid in Purchases section, some users tend to forget to mark them as paid. Instead they enter the expense again in the bank reconciliation section. Often payments are made direct from the bank or credit card but the bill entered is not being marked as paid. The result is a new transaction being recorded and expense or income duplicated in the accounts. If you are paying a bill that is already entered in Xero, you must be on the Match screen. Only use the Create screen when you are entering a new expense that isn’t already on the system and be consistent.

4. Using ‘Unreconcile’ when you’ve made a mistake

When correcting entered and reconciled bank transaction selecting ‘unreconcile’ doesn’t reverse the error. The coded transaction sits in the bank account as an unreconciled item. This can cause doubled up transactions in your final bank reconciliation. Always select ‘Remove and Redo’ to clear the reconciled line and the transaction.

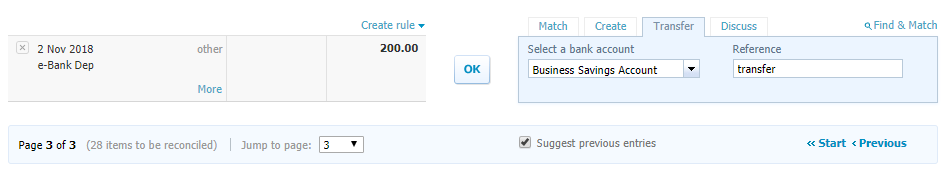

5. Making transfers between two bank accounts

When recording a transfer between two bank accounts, users tend to code it as a transfer in both accounts, which results in unreconciled transactions in both. This gives you the wrong bank balance, if not corrected. To avoid this, record the transfer in one bank account. Xero will create the corresponding transaction in the second bank account. All you need to do is go to the second bank account reconciliation screen and match the Xero created transfer transaction.