What is a profit and loss statement?

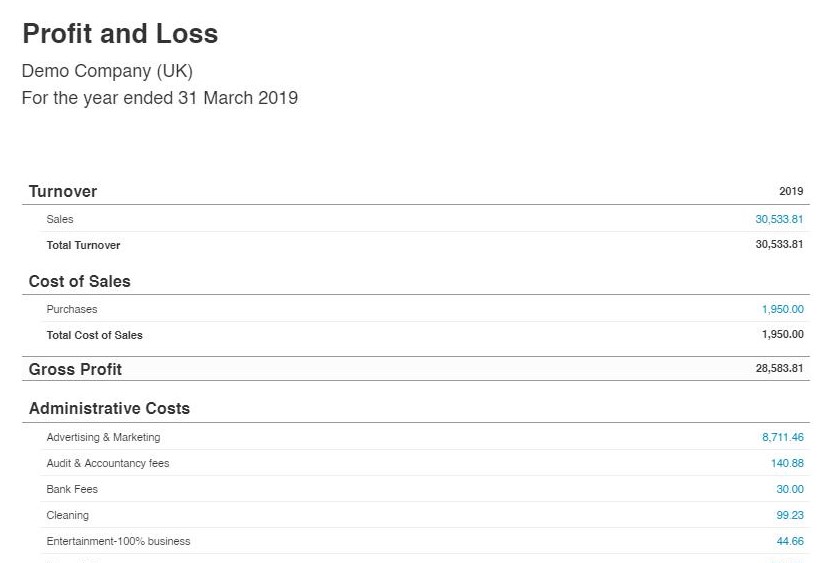

A profit and loss statement shows how much your business has spent and earned over a specified time. This shows whether your business has made a profit or loss during that time – hence the name. A profit and loss statement might also be called an ‘income statement’, a ‘statement of operations’, a ‘statement of earnings’ or a ‘P&L’.

A profit and loss statement shows all your revenue and expenses. This includes things like payroll, advertising, rent and insurance. It will also show your earnings from sales and other forms of income.

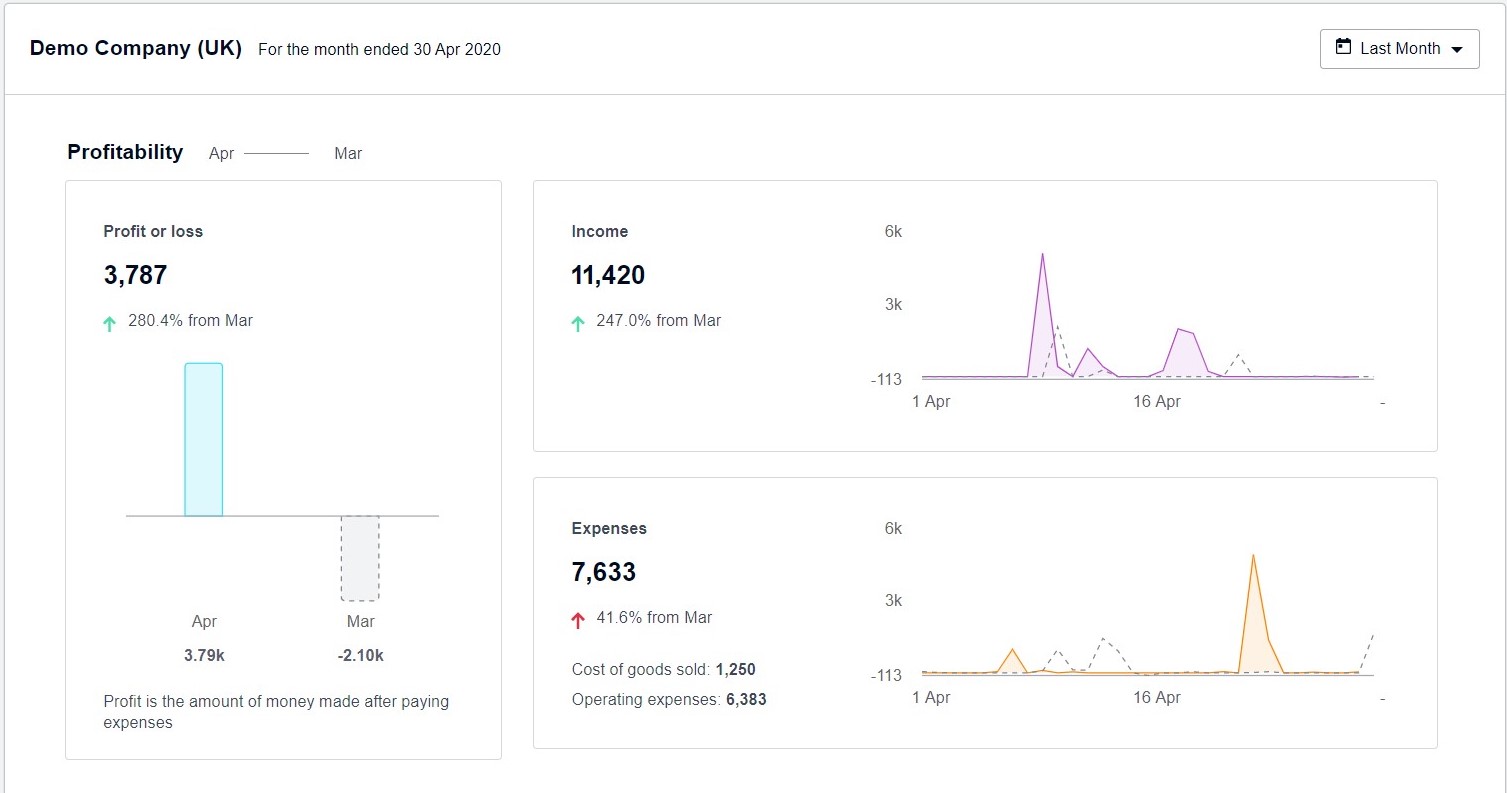

Your total profit or loss for the time period you’ve chosen is what you’ve earned minus what you’ve spent. If this amount is positive, it’s called a net income. If it’s negative it’s called a net loss.

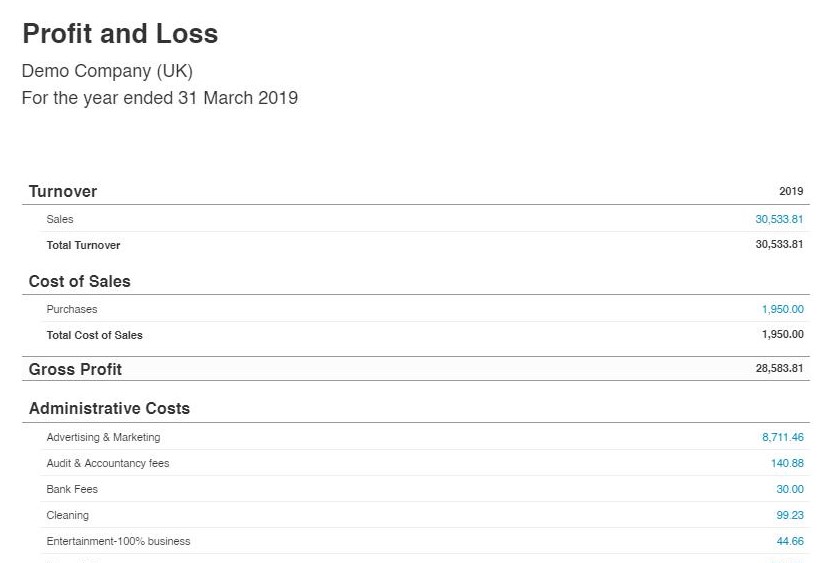

What does a profit and loss account include?

A profit and loss account will include your credits (which includes turnover and other income) and deduct your debits (which includes allowances, cost of sales and overheads). These are used to find your bottom line figure – either your net profit or your net loss.

What is a profit and loss account used for?

The profits shown in your profit and loss account are used to calculate both income tax and corporation tax. Failure to file either of these correctly can result in you paying added interest and penalties, so it’s important to get this report right.

The P&L account takes revenues into account for a specific period. It also records any expenses or costs incurred by these revenues, such as depreciation and taxes.

This can be used to show investors and other interested parties whether or not the company made money during the period being reported.

Why You Need to Prepare a P&L Statement?

If you have your P&L statement on hand, you are able to look back on it to review how well your company fared over a chosen period of time. With the results in mind, you will then be able to make better financial decisions, as you’re armed with concrete knowledge of how your business is doing in terms of revenue and expenses. Provided that the numbers aren’t in the red, you will be able to invest money back into your business and make decisions that would have otherwise required dangerous guesswork.

Preparing a profit and loss statement and reviewing it regularly will give you insight into areas of the business where you are making money (or losing money). It will also provide you with where you are spending your money which can help you determine where you may be able to cut costs.

- Have Proof of Your Business’ Success

Having your P&L statements on paper means that you’re able to show a chronological record of how well your business has been doing over the course of its operation, allowing you to play your cards right around investors, or with buyers if you have the intention of selling the business. It also serves as a measure of trust, as it may be requested by any new clients who wish to do business with you.

- Prepares You to File Taxes

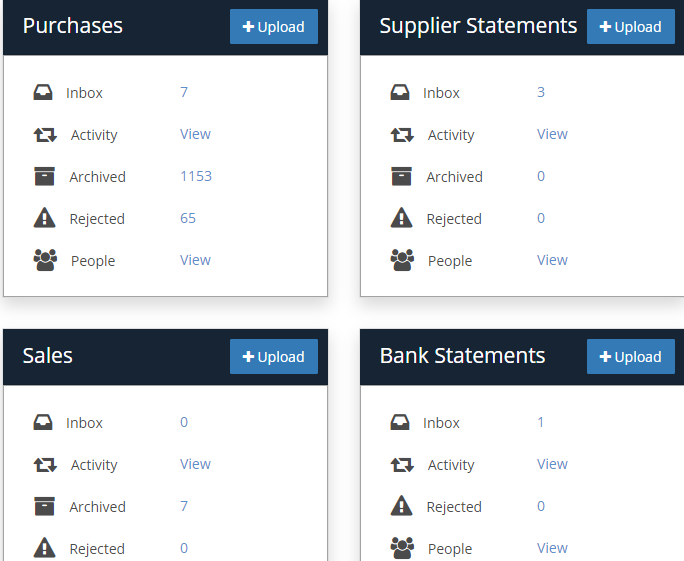

If you regularly update your P&L statements (as well as your other financial statements), you’ll have all the information you need for sorting out your business taxes when the day inevitably arrives. Updated financial statements also mean that your accounting software is also being regularly updated.

How to read Profit and Loss Report

If we want to understand a company report, we need to know what all the income, expense and profit figures mean. The Profit and Loss Statement is explained as follows:

Add all income from sales for the period the profit and loss statement includes whether or not you’ve received payment for the sale. We might sometimes see this figure broken down into revenues from continuing operations and revenues from new business, which is a useful way of comparing like with like for a company that is expanding into new businesses or disposing of old ones — we can use the breakdown to help see how its core business is performing year-on-year. And different companies might show slightly different breakdowns, but we’ll always see a figure for total revenues.

These are all costs directly associated with the sales mentioned above. They may include the cost of the product purchased and wages for people making the product. For example, if you are a consultancy, your cost of sales might include Advertising, Freelancer or sub-contractors etc.

Gross profit is simply the difference between your sales and cost of sales.

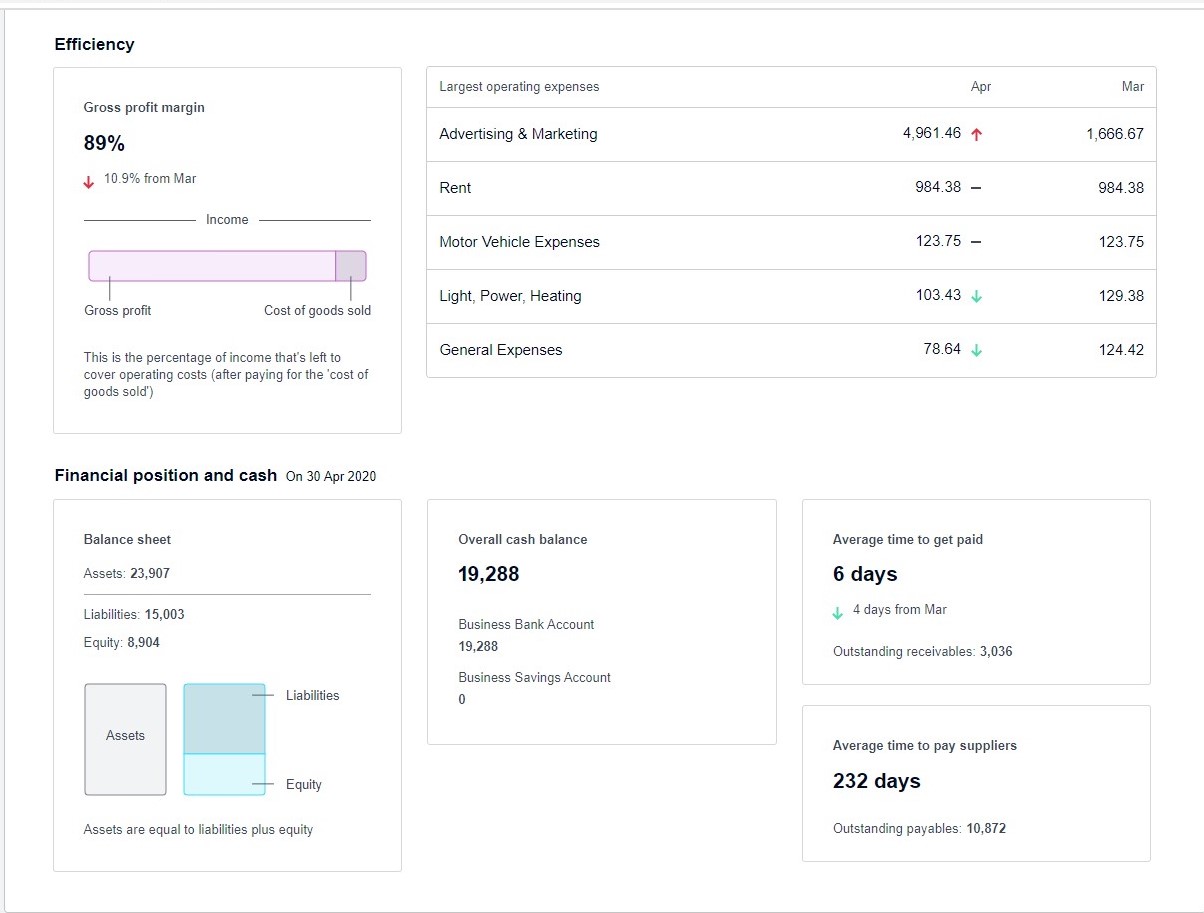

The gross profit margin is probably one of the most important figures to the business owner and manager. It shows the sales mark-up and can therefore highlight inefficiencies and pricing issues.

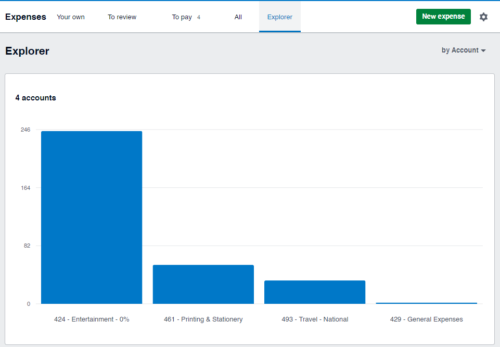

Expenses or overheads are all other costs you’ve received invoices for during the period. These may include:

- Rent and rates

- Professional fees, such as legal and accountants

- Advertisement

- Travel

- Entertainment

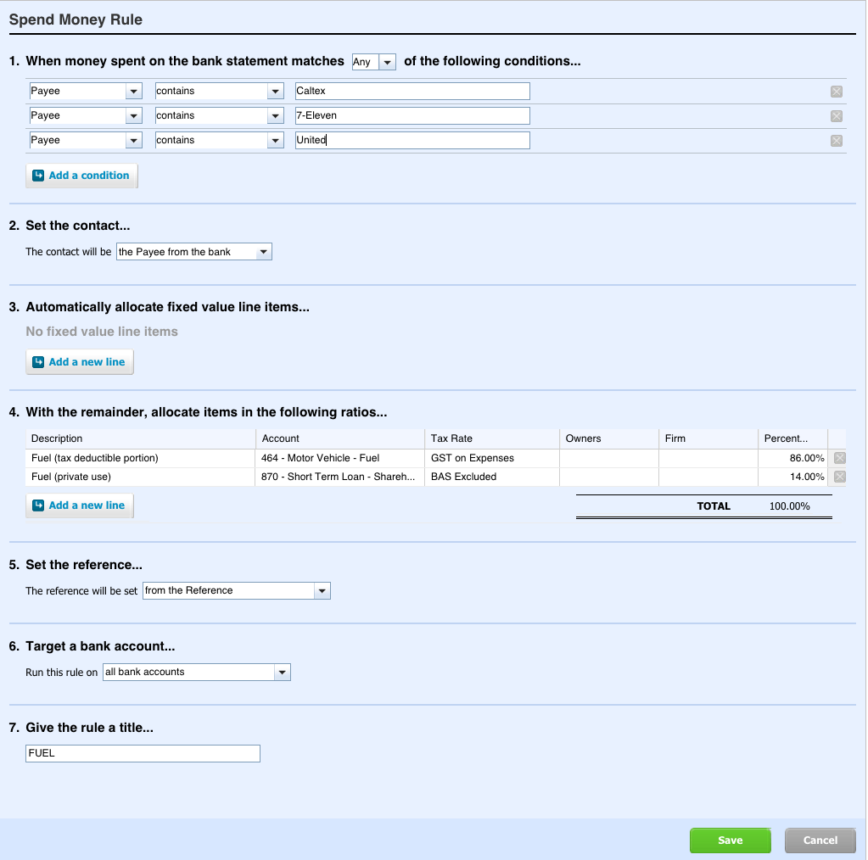

- Vehicle costs such as fuel and maintenance

- Technology and computer costs

- Office staff salaries, national insurance, pensions, and bonuses

- Stationery and postage

- Utility costs such as heating, water, gas, and electricity

- Depreciation: This line is an accounting adjustment and not directly used for tax calculation purposes. Depreciation represents the periodic, scheduled conversion of a fixed asset into an expense as the asset is used during normal business operations. Since the asset is part of normal business operations, depreciation is considered an operating expense.

- Profit before tax and interest

This calculation is an indicator of a company’s profitability. By ignoring taxes and interest expense, it focuses solely on a company’s ability to generate earnings from operations, ignoring variables such as the tax burden and capital structure.

This entry summarizes interest and bank charges paid from your business within the accounting period.

Tax will be the estimated amount of corporation tax on the business

And finally, the net result is what’s left. It’s a calculation of all income less all expenses and purchases less interest and tax paid providing your overall profit or loss in the period of the accounts.

Interpreting and understanding the profit and loss account

If your business is fairly consistent, look for comparisons with previous years. If there are any deviations from the general trend, ask yourself if you are able to explain them.

Also, look for comparisons with your competitors and the industry the business operates in.

Ultimately, the profit and loss account should tell a story of what has happened during the year, so you as the business owner/manager are best placed to make sure the profit and loss account shows a true reflection of this ‘story.’

Your bookkeeper can help you to understand and interpret the figures in the profit and loss account and can highlight the areas that may require further investigation. They will also be able to identify any ‘anomalies’ which might trigger the attention of HM Revenue & Customs, such as a large increase in the cost of repairs or a dramatic downturn in drawings. If you need any help with interpreting your Profit and Loss Statement, we at Cloudit Bookkeeping, will be happy to assist you.