Making Tax Digital for VAT made easy with Xero

If you are already using Xero or looking for software to help you file your VAT returns Xero is now ready for MTD.

Here is their short flyer for more information: Making Tax Digital for VAT made easy

If you are already using Xero or looking for software to help you file your VAT returns Xero is now ready for MTD.

Here is their short flyer for more information: Making Tax Digital for VAT made easy

HMRC have release this short video regarding Making Tax Digital for VAT (MTD) and how it will affect businesses with taxable turnover over £85,000.

To ensure you are ready to keep and file your VAT returns electornically starting from April 2019, we advise to set up your systems in advance. We are huge fans of Xero online accounting package which is MTD ready. Start this January and you will have enough time to get used to software and test it.

Xero is cool and easy to use cloud-based accounting software designed for small and medium-sized businesses. However mistakes can occur and carelessness can result in many hours of wasted time trying to locate the error and rectifying it. Let’s look at some of the most common mistakes in bank reconciliation and how they can be avoided.

1. Trusting bank feed 100%

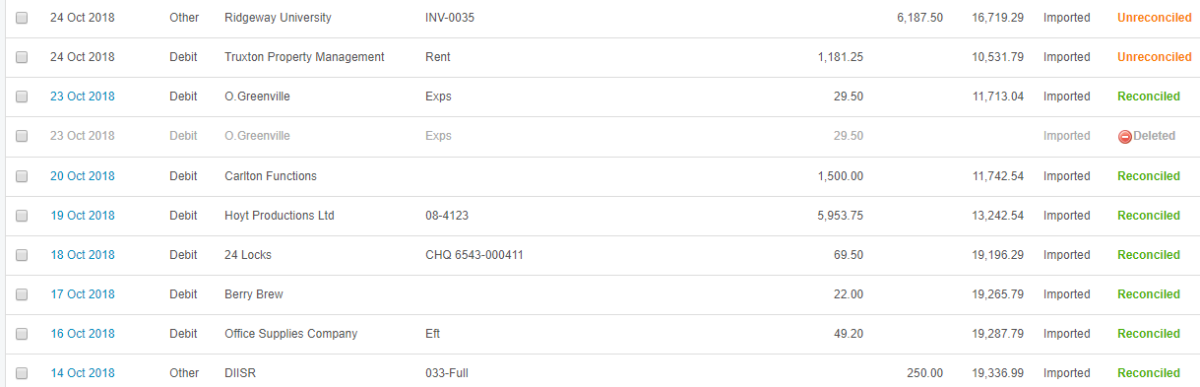

Direct bank feeds are amazing and most of the time we do not have any errors as they work perfectly. However, it can happen that there is a break in the feed and a day or more are missed, especially if you don’t reconnect the bank feed in good time. This will result in unrecorded expenses or customer payments unasigned to their invoice which you want to chase. Sometimes bank lines can be duplicated, for example on a credit card feed or bank feed where the transactions comes in on the day of the purchase and on the day it has cleared the account. If you reconcile all of these you will end up with double income and expenses in your accounts. To make sure everything is in order, regularly check your actual bank account balance with the running bank balance in Xero. If this does not match, you will need to compare your bank statements with Xero to find what is missing or imported twice.

2. Paying invoices/bills

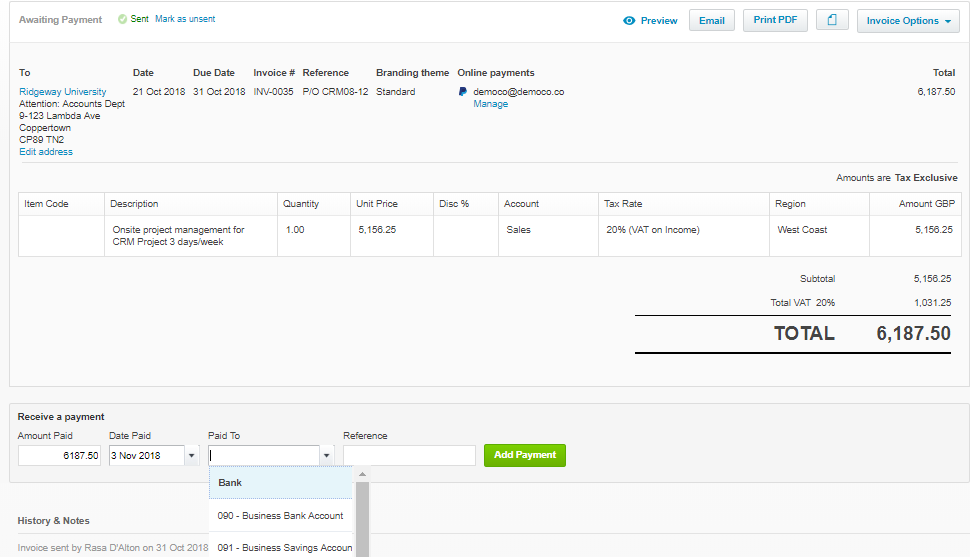

When marking sales invoices as paid in sales module or purchase invoices in purchases module, some users mistakenly record payment to/from the wrong bank account. This will cause reconciliation problems later on, as the invoice will not be available to assign bank payment against. To avoid this, always double check the selected bank account in the drop down menu when paying the invoice. Always run reconciliation report to check for anything out of place.

3. Bills to be paid vs reconciliations

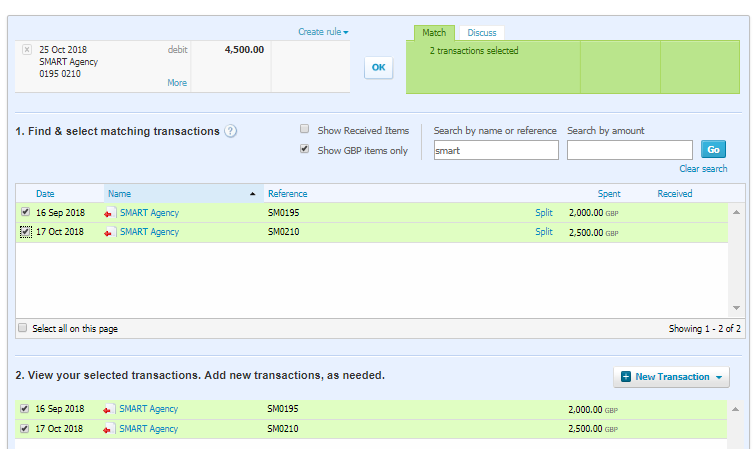

When entering bills that need to be paid in Purchases section, some users tend to forget to mark them as paid. Instead they enter the expense again in the bank reconciliation section. Often payments are made direct from the bank or credit card but the bill entered is not being marked as paid. The result is a new transaction being recorded and expense or income duplicated in the accounts. If you are paying a bill that is already entered in Xero, you must be on the Match screen. Only use the Create screen when you are entering a new expense that isn’t already on the system and be consistent.

4. Using ‘Unreconcile’ when you’ve made a mistake

When correcting entered and reconciled bank transaction selecting ‘unreconcile’ doesn’t reverse the error. The coded transaction sits in the bank account as an unreconciled item. This can cause doubled up transactions in your final bank reconciliation. Always select ‘Remove and Redo’ to clear the reconciled line and the transaction.

5. Making transfers between two bank accounts

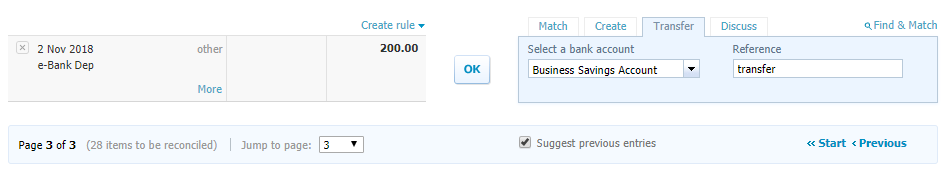

When recording a transfer between two bank accounts, users tend to code it as a transfer in both accounts, which results in unreconciled transactions in both. This gives you the wrong bank balance, if not corrected. To avoid this, record the transfer in one bank account. Xero will create the corresponding transaction in the second bank account. All you need to do is go to the second bank account reconciliation screen and match the Xero created transfer transaction.

There are a few things you must consider when creating and issuing an invoice.

Legally required information, consecutive number, payment account details and payment terms just to name a few. This handy guide covers it all and more. Pick it up from Xero website or download it here.

To download the detailed invoicing guide, click here

UK INCOME TAX BANDS 2018/2019

(excluding Scotland)

MAIN PERSONAL ALLOWANCES

MAIN DUE DATES FOR TAX PAYMENT

If you’d like to keep a copy of the above information, here is a link to download the PDF: Main Income Tax Rates 2018_2019

If you are self-employed, you would have received the brown envelope from HMRC reminding you that it is TIME – time to file yet another tax return. Funny, how quickly a year can fly by!

Now that you have cleared a weekend to sort it all out (or at least put a date in your diary to get it sorted!), let’s have a look at what you shouldn’t do this year when dealing with your tax return.

Firstly, do not wait until the last minute and miss the deadline.

An online version of the tax return can be completed and submitted electronically allowing you until 31 January to file it with HMRC. The paper version needs to be submitted by 31 October following the end of the tax year. However this will not be an option for too much longer. HMRC are on a path of digitalising tax system with the first step being VAT returns and other taxes will be next.

If you do miss your deadline, the penalties are harsh:

Secondly, do not claim expenses which are not tax deductible.

Expenses included in your trading profit calculation must be wholly and exclusively for business purposes. When adding up your expenses do not include disallowable items. We have put together some examples, however you should consider each expense and the purpose for which it has been incurred before deducting it from your trading income.

Do not include these expenses:

If you are employed, there might be expenses you can claim through your self-assessment tax return if these have not been reimbursed by your employer. What tax relief you can claim for your job expenses can be found on HMRC website here.

If you need help with your self-assessment, an ICB qualified bookkeeper can help you and guide you through it. Get in touch for a chat about how we could help.

Bookkeeping is the recording of financial transactions and other information related to the business on a day-to-day basis. It is a vital part of every business.

Bookkeeping records collate information and provide business owners with vital reports on progress and growth. It also calculates tax liabilities the business has and will have in the future.

There are several standard methods of bookkeeping, such as the single-entry bookkeeping system and the double-entry bookkeeping system.

Single-entry bookkeeping uses only income and expense accounts, recorded primarily in a revenue and expense journal. Single-entry bookkeeping is adequate for many small businesses.

In the double-entry accounting system, at least two accounting entries are required to record each financial transaction. These entries may occur in asset, liability, equity, expense, or revenue accounts. Every transaction involves a debit entry in one account and a credit entry in another account. This serves as a kind of error-detection system: if, at any point, the sum of debits does not equal the corresponding sum of credits, then an error has occurred.

Common financial transactions and tasks that are involved in bookkeeping include:

Correct bookkeeping gives companies a reliable measure of their performance. It also provides information on general strategic decisions and a benchmark for its revenue and income goals.

Accurate bookkeeping is also crucial to external users, which include investors and financial institutions that need access to reliable information to make better investment or lending decisions, or the government.

You can learn double-entry bookkeeping and maintain your own books. But not all business owners have time or aptitude to learn tax and VAT rules and how to apply these to each transaction which goes through their business. This is where a qualified bookkeeper can make a huge difference. Bookkeepers can be employed by the business to oversee the financial side and provide crucial information to the owners and managers. They can also be hired on contract basis for a few hours per week or month to keep things in good order.

Will you spend your Friday evening working through your paperwork and reading HMRC website?

Maybe it’s time to search for a bookkeeper…

What is a Bookkeeper?

A bookkeeper is a trained and qualified professional who records financial transactions and produces financial records for the businesses.

Bookkeepers deal with tax returns on your behalf. They enter all the relevant data into accounting software and deal with a whole set of tasks outside data inputting and accounts reconciliation.

Bookkeepers have an in-depth understanding and experience with accounting software. This enables them to produce various reports such as profit and loss, gross profit and net profit margin percentages, specific expenditure tracking and more.

What does a Bookkeeper do?

A bookkeeper will usually perform the following tasks on a regular basis:

The records a bookkeeper works with include:

A bookkeeper is often responsible for some or all of the business’ accounts, known as the general ledger. They record all transactions and post debits and credits. They also produce financial statements and other reports for managers and business owners. Bookkeepers can manage banking and supplier payments. In addition, they may handle payroll, make purchases, prepare sales invoices, and keep track of overdue accounts (credit control).

Do I need a Bookkeeper?

Bookkeeping is a vital part of every business. Get it right from the start and it will provide you with valuable information to make informed business decisions and, of course, peace of mind that your records are accurate. While bookkeeping can be done by the business owner or their partner, accountants do recommend that a qualified bookkeeper is engaged to ensure the quality and accuracy of financial records. Putting your records together is a time consuming task – your time is better spend working on the business.

Ready to hire a bookkeeper? Our expert bookkeepers are here to help and free up your time for the things that matter to you most.

WHAT YOU NEED TO KNOW AND PREPARE BEFORE APRIL 2019

HMRC has announced their plan to make tax digital by 2019. Under the new scheme, people will have online tax accounts that track their professional and business transactions automatically. These accounts will be submitted quarterly to HMRC to estimate the taxes due.

The online system is intended to be more transparent while removing some of the inaccuracies and inefficiencies that hinder paper tax filings.

This is not the same as lodging a return online. Making tax digital has three important distinctions:

While Making tax digital has been on the agenda for some time, the latest government finance bill has proposed a two-part roll out:

What does it mean for your business?

Your business will need to use some form of software to keep your VAT records and file VAT returns if you fall into the above category. Remember this will become a requirement from 1st of April 2019.

For other forms of tax, your business will likely be required to submit accounts every quarter which is scheduled to take effect in 2020. Thus keeping your records electronically will become essential.

More frequent submissions will help your business avoid nasty surprises. Big tax bills can accumulate over the course of a year but when tax is calculated quarterly, things are far less likely to get out of hand.

If your business chooses to use accounting software, you should make sure it has online capabilities. Desktop accounting software hasn’t traditionally been able to submit tax online.

As a bonus, online accounting software also allows you to:

Online accounting software can also sync with other online services such as POS software, inventory management software, or time-recording apps.

Where do I start?

Don’t think of making tax digital as just another obligation. This is your opportunity to regularly check income, expenses and profit in your business – which will help you make better decisions. Take these three steps to help make the transition smooth.

Making tax digital could be really good for your business

Change can often seem daunting, especially if it requires you to adopt new technology. However, quarterly tax filing could actually lessen your workload. And by updating your accounts more often, you’ll be able to react faster to opportunities and threats in the business.

For help setting up your digital accounts and VAT reporting, speak to our qualified bookkeepers today.

Source: xero.com

What is GDPR?

The GDPR comes into force in May 2018. It’s a wide-ranging regulation designed to protect the privacy of individuals in the European Union (EU) and give them control over how their personal data is processed, including how it’s collected, stored and used. It affects every company in the world that processes personal data about people in the EU.

What does GDPR mean?

Although GDPR might seem scary at first, many see it as a positive step forward for data protection. Some of the key areas GDPR covers are:

The UK government will be replicating GDPR into UK law prior to Brexit, so if you’re a UK company, Brexit won’t impact your obligation to comply.

GDPR and data protection

It’s important to understand the spirit of GDPR. The legislation came into existence because of the way personal data has been treated in the past. Many companies treated personal data as a resource they could utilise without regard to the rights of individuals.

For example, some companies sold customers’ email addresses, allowed sensitive data to be seen by unauthorised people, and failed to adequately protect data against hackers.

GDPR gives control of personal data back to the people who own it and requires organisations to make data protection a core part of their operations and processes. This is likely to affect big, data-driven organisations first. But small businesses aren’t exempt. We’ve set out some steps below that you can take to make sure you’re prepared.

Goes GDPR affect data security?

Data security is a big part of GDPR. If you process personal data of people in the EU you have a duty to keep it safe so it’s important to ensure that any personal data held by you is securely stored.

GDPR also governs where companies store personal data, and what safeguards you must have in place in order to store and process that personal data outside of the EU. For example, if you’re transferring personal data to a US-based company (that will store and process it in the US), you should check that they’re certified with Privacy Shield, which is a mechanism designed to allow data transfers from the EU to the US.

Summary of GDPR for small business

There are many aspects to GDPR, but it really boils down to being clear and ethical with the personal data you process – that means treating it as you’d treat something valuable of your own. Some initial practical steps you can take to get GDPR compliant are:

Check products and services

Review notices and contracts

Assign responsibility

Take care over security

GDPR resources for small businesses

You can get useful information on GDPR from:

The UK Information Commissioner’s Office (ICO) – 12 steps to prepare for GDPR.

The Federation of Small Business (FSB) – How to prepare for GDPR.

You should also talk to your legal advisers to ensure you are compliant before May 2018.

source: Xero.com

It is a big day for Cloudit Bookkeeping today.

I have finally stepped outside my comfort zone and moved from my bright and rather white home office to my first ‘grown up’ rented space in Severalls Industrial Park. Those who know me will know that adding overheads is not something I enjoy doing, if anything I’d rather cut them (maybe that’s why I like saving my clients money too). So why make the move?

Firstly, becoming an employer made me think of how to make the working environment better for all of us and being in an office where employees could come and go when I am not there made sense. It also gives us space to meet with clients, especially those who work from home themselves. Secondly, being at business premises is the step in the right direction to grow my practice and add staff in the future.

I have been looking for a serviced office for quite some time in Colchester and small offices get taken up very quickly. The pressure when something comes up is big and my advice for those who want to rent is to calculate the rent figure you can afford before you start looking and keep to it. This way you will ensure that you are not overstretching your finances and will negotiate harder to get the price right for you. Make sure you get all the additional costs of the office included, such as parking fees, broadband, telephone lines, business rates and anything else the landlords are going to charge you extra for or you will have to get yourself. Remember to include VAT figures, if you are not VAT registered in your calculations. Next, do some simple sums. Look at your last year’s net profit figure and subtract the annual rent amount. Does this leave you with enough for your own pay or will you have to add revenue to make it work. And if you were to increase your sales, what will be your gross profit figure and will it require additional staff and at what cost.

Get in touch if you need any help getting you figures together hello @clouditbookkeeping.co.uk or pop in to see us at our new office for a quick chat.

If you are worried that your staging date is getting closer and you have not read about automatic enrolment and what effect it will have on you as an employer, this short summary will help you put your mind at ease.

All employers have to enrol all employees into a workplace pension scheme and by October 2018 all employers will be required to offer workplace pension to eligible workers. So how do The Pension Regulator classify all the workers? (earning levels quoted are as at August 2016)

Eligible jobholders

Eligible jobholders are eligible for automatic enrolment into a scheme that meets certain legal standards if they’re not already members of a qualifying scheme.

Non-eligible jobholders

or

Non-eligible jobholders aren’t eligible for auto enrolment but can choose to opt in to a pension scheme that meets certain legal standards, if they’re not already a member of a qualifying scheme. If they opt in they are eligible for employer contributions.

Entitled jobholders

Entitled jobholders can ask to become a member of a workplace pension scheme. This is only if they’re not already members of a workplace pension scheme. There is no duty for you to make employer contributions.

If you have no eligible jobholders you are not required to set up a pension scheme. However if an employee decides to opt into or join a pension scheme the employer must then set one up.

Staging Date

Your staging date will be issued to you by The Pension Regulator via a letter. This date is when you must begin automatic enrolment process and offer a workplace pensions scheme if you have the above jobholders. You can find your staging date by entering your employer PAYE number on The Pension Regulator website: http://tpr.gov.uk/ .

Postponement

An employer may postpone enrolling employees for a maximum of three months. This can be done for individual employees or for all employees. There are many reasons why an employer may use postponement, for example to:

Communication

Communication is a must when it comes to auto enrolment and can be the most time consuming part of the process. You will have to write to each employee individually depending on which category they fall into. Eligible, non-eligible and entitled jobholders all have different rights and so each must receive a different letter outlining their entitlement. There are also time limits in place to ensure that employees have enough time to gather information on auto-enrolment so that they can make an informed decision.

Opting Out & Opting In

Once an employee is enrolled they have 30 days opt out period in which they may choose to opt out and get a full refund of all deductions made. If employee wishes to leave the scheme after the opt-out period has expired, they can do so by stopping their membership with the scheme – scheme rules will apply. It is illegal for an employer to encourage or influence employees in any way so that they opt out of the workplace pension scheme.

If non-eligible jobholder chooses to opt into your auto enrolment scheme, they can do so in writing. Although they are not required to be automatically enrolled, they are still entitled to both employer and employee pensions contributions. Entitled jobholders may wish to also join the scheme and pay employee contributions, however it is not a legal requirement for you to contribute too.

Compliance

You will be required to fill out Declaration of Compliance within 5 months of the stating date. This allows The Pension Regulator to monitor employers and to ensure that they are complying with their duties. You will receive a penalty for non-compliance.

Deductions & Contributions

You, as an employer, will have the responsibility to make deductions from employees pay and also pay employer contributions. The contribution rates are agreed when setting up your pension scheme, which must be at or above the minimum amount set by law. Here is the table of current minimum contribution levels:

| Period | Employer minimum contribution | Employee minimum contribution | Total minimum contribution |

| Before April 2018 | 1% | 1% | 2% |

| 6 April 2018 to 5 April 2019 | 2% | 3% | 5% |

| 6 April onwards | 3% | 5% | 8% |

Ongoing Responsibilities

You will have ongoing responsibilities as an employer to manage opt in and out requests, monitor new and existing employees in order to check for any change to their worker category, keeping records up to date, re-assessing employees every three years, and submitting a contribution file to the pension provider after each period.

Keeping Records

You must keep all workplace pension related documents and records for at least 6 years.

Re-enrolment

You are required to enrol eligible jobholders who have opted out every three years. You will also be required to complete a re-declaration of compliance every three years. If an employee opted out three years ago and is still an eligible jobholder, you must re-enrol him/her into the workplace pension.

This is just a quick summary of what is involved in managing auto-enrolment and you can find detailed guides on The Pensions Regulator website: http://www.thepensionsregulator.gov.uk/.

At Cloudit Bookkeeping, we manage auto enrolment process for our payroll clients and if you have any questions or concerns we are here to help. Email us at hello@clouditbookkeeping.co.uk or call 01206 700252.

If you are in a situation where you need to issue a self-billing invoice to your supplier, you might find that Xero currently does not have this function. This is common in many industries especially where the purchaser has the answer on how much needs to be billed.

If you are stuck trying to figure out how to get round self-billing issue on Xero, we found a quick process using Purchase Orders. Here are the steps you can follow to achieve the required result:

Before you start the self-billing process you might want to read HMRC guidance on VAT: self-billing arrangements (https://www.gov.uk/guidance/vat-self-billing-arrangements).

And if you need some help setting this process up, we are here to give you a hand.

Based in Ardleigh, Essex we offer bookkeeping services to businesses in Essex, Suffolk & anywhere in the UK.